If you're wondering how to use the gov.uk website to check your business' HMRC position for PAYE or VAT, follow our step-by-step guide below.

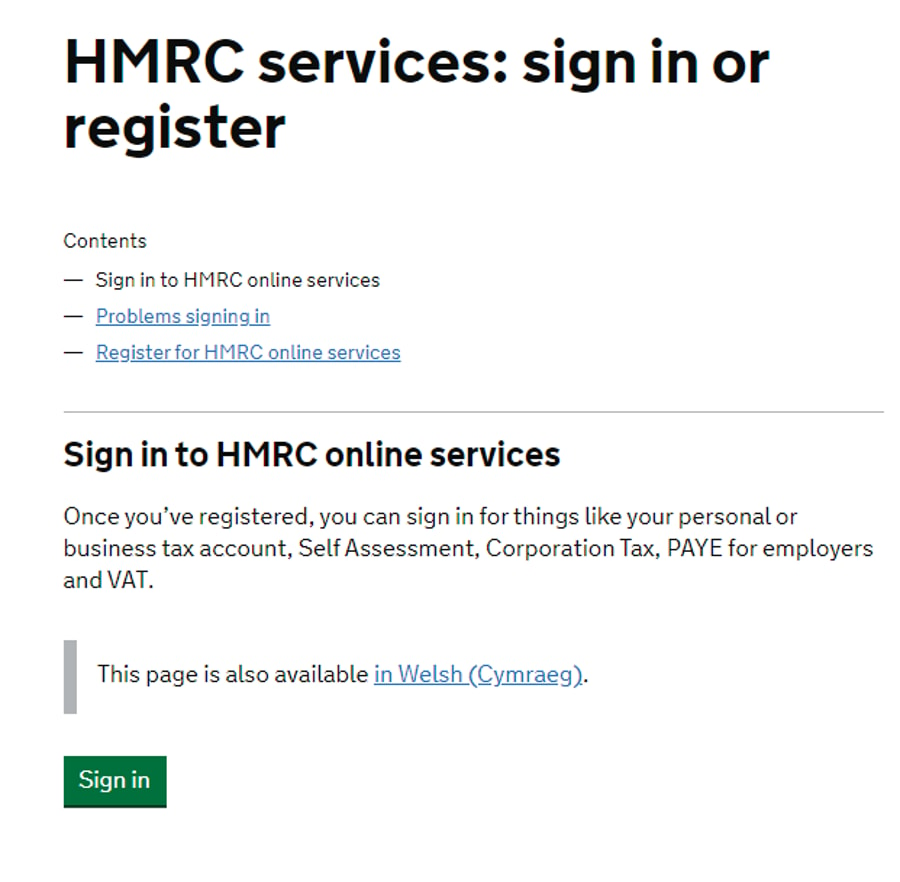

Step 1

Visit the HMRC online services website here. Click the green 'sign in' button as shown below.

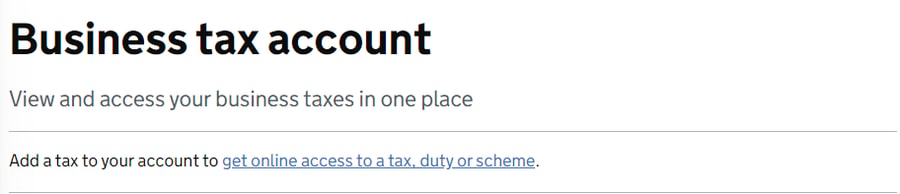

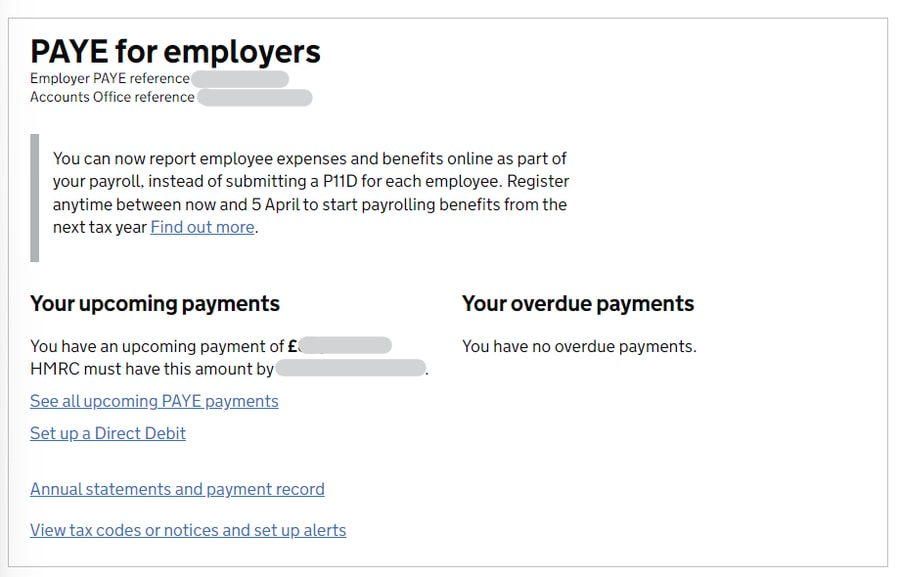

Step 2

Within the ‘Business tax account’, you'll find a section titled 'PAYE for employers'. There, you'll be able to see a summary of amounts soon to be due and overdue. This is your HMRC position for PAYE.

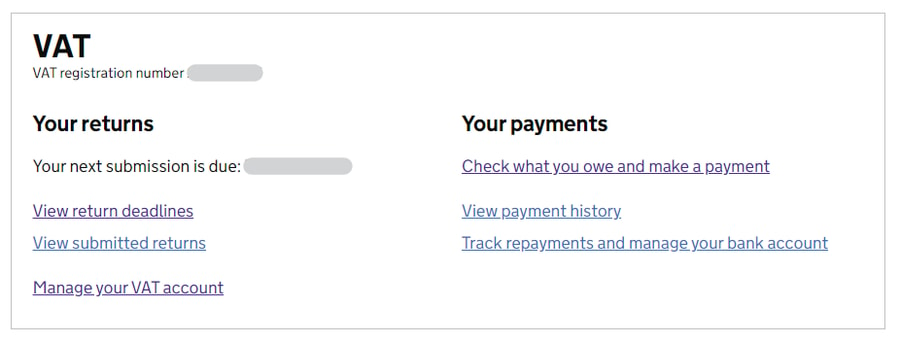

Step 3

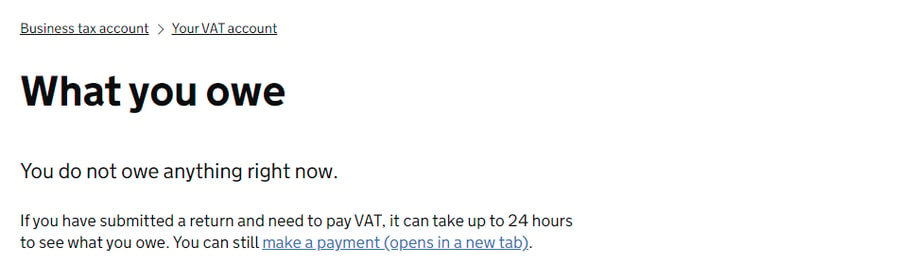

Click ‘Check what you owe and make a payment' under the Your payments section.

Step 4

This will show you your HMRC position for VAT

If you want a step-by-step guide covering how to access your VAT returns, you can view ours here.

These cookies are set by a range of social media services that we have added to the site to enable you to share our content with your friends and networks. They are capable of tracking your browser across other sites and building up a profile of your interests. This may impact the content and messages you see on other websites you visit.

If you do not allow these cookies you may not be able to use or see these sharing tools.