As a multi-award-winning digital business lender, Fleximize was built on the principles of providing fast and flexible funding for small businesses, with transparency throughout our process. But we’ve taken this a step further. The “Penalty-Free Promise” is our pledge to provide fair and honest finance to you, and to not penalise you if you want to repay your loan early.

As a Fleximize customer, if you want to repay your loan early, we promise not to charge you any early repayment fees, and you’ll only pay interest for the time you’ve actually had the loan.

This should be the norm amongst business lenders, but unfortunately, it’s not. Many still charge interest for the full, original loan term - this means that if you’re in the fortunate position of being able to repay your 24-month loan after six months, you’ll still pay 24 months’ worth of interest.

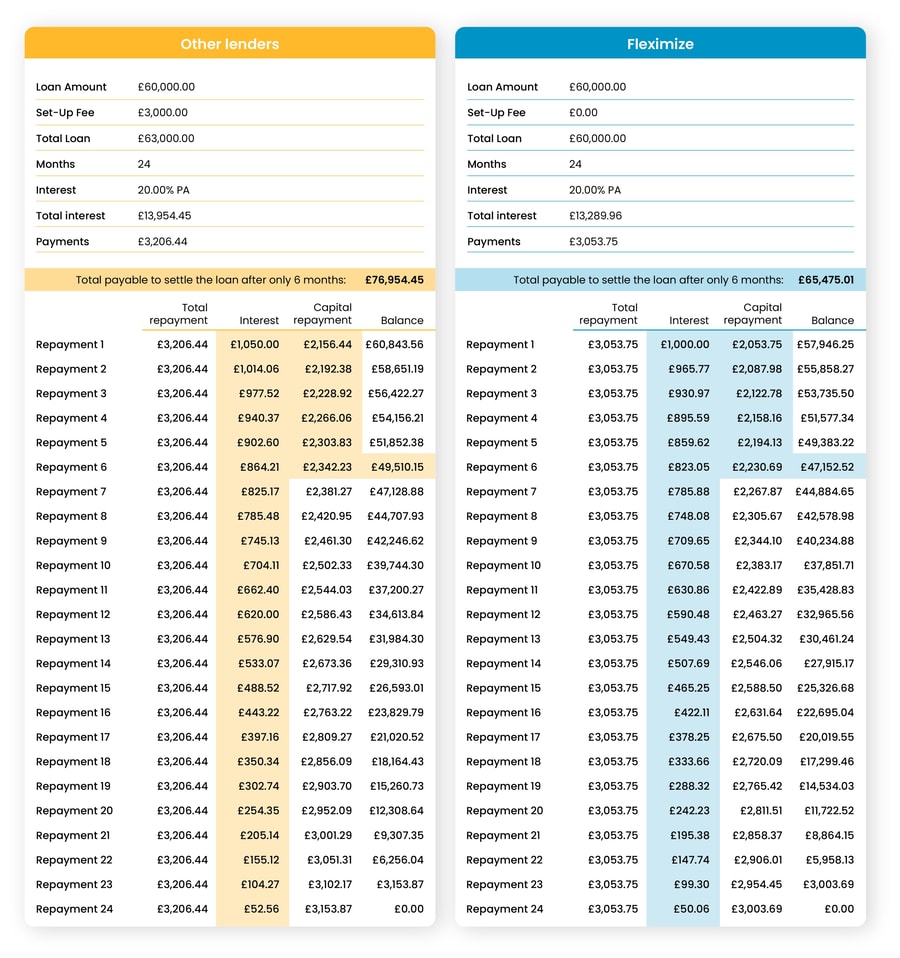

Worse still, with interest rates being the usual way to compare business loans, many of those lenders will add hefty fees when taking out finance with them or trying to repay your loan early. We think these practices are wrong. For this reason, it’s important to look at the overall cost of finance when comparing business loan offers, not just the advertised interest rate, as that doesn’t always mean it is cheaper.

No hidden fees, ever

We like to keep our pricing simple and transparent. So, you’ll always know what you’re paying upfront and we’ll never hide any fees along the way. Here’s how we compare:

| Other Lenders | Fleximize | ||

|---|---|---|---|

| Many charge a fee if you wish to repay your loan early. | We don’t charge any early repayment fees whatsoever. | ||

| Those that don’t will still charge you interest based on the original loan term, so if you’re repaying your 24-month loan after six months, you’re paying 18 months of interest that you shouldn’t be. | With Fleximize, you only pay interest for the time you’ve had the loan. If you want to repay your 24-month loan after six months, you'll only pay interest for the six months you had the loan. | ||

| Some lenders won’t let you make overpayments, therefore if you’re ahead of schedule but you don’t have enough to settle your loan in full, you won’t be able to save on interest. | Our loans are amortising and you can make overpayments anytime - you’ll save on interest if you want to make overpayments without settling in full. | ||

Our loans also amortise, meaning with every capital repayment, your interest payments come down, and your next interest payment is based on the capital outstanding, not the original loan amount.

Repay early, repay less

Here’s a handy example loan schedule comparison based on a loan of £60,000 over a term of 24 months at an interest rate of just over 20%.

Amortisation

Loan amortisation is one of those financial terms that few people outside of a bank or lender are likely to know. However, it’s actually a really important factor to consider when deciding which lender to borrow from. Here’s how amortisation works and how it could affect you.

When you make a loan repayment, your payment is made up of two separate payments – one which is your capital repayment (this pays off the amount you borrowed) and your interest payment (this covers the cost of borrowing the capital).

When a loan is amortising, each interest payment is calculated based on the balance after your previous payment, rather than having a fixed interest payment. This means that the more capital repayments you make, the lower each interest payment is.

Both our Flexiloan and Flexiloan Lite are amortising. With each repayment, the amount you’re paying in interest comes down, and the amount that goes toward paying off your loan increases. This means that more of your repayment goes toward paying off the debt, resulting in your loan being paid off quicker. At the same time, your total monthly repayment remains the same, making it easier to forecast.

Got questions?

At Fleximize, we get that taking out a business loan can get a bit confusing, which is why we’ve built a handy early repayment calculator here. Our team will happily talk you through the ins and outs of our products, so feel free to give us a call on 0207 1000 110. Alternatively, if you're ready to apply, simply click the button below.

020 7100 0110

020 7100 0110

These cookies are set by a range of social media services that we have added to the site to enable you to share our content with your friends and networks. They are capable of tracking your browser across other sites and building up a profile of your interests. This may impact the content and messages you see on other websites you visit.

If you do not allow these cookies you may not be able to use or see these sharing tools.