Key Details

The business

Trading for: 7 years+

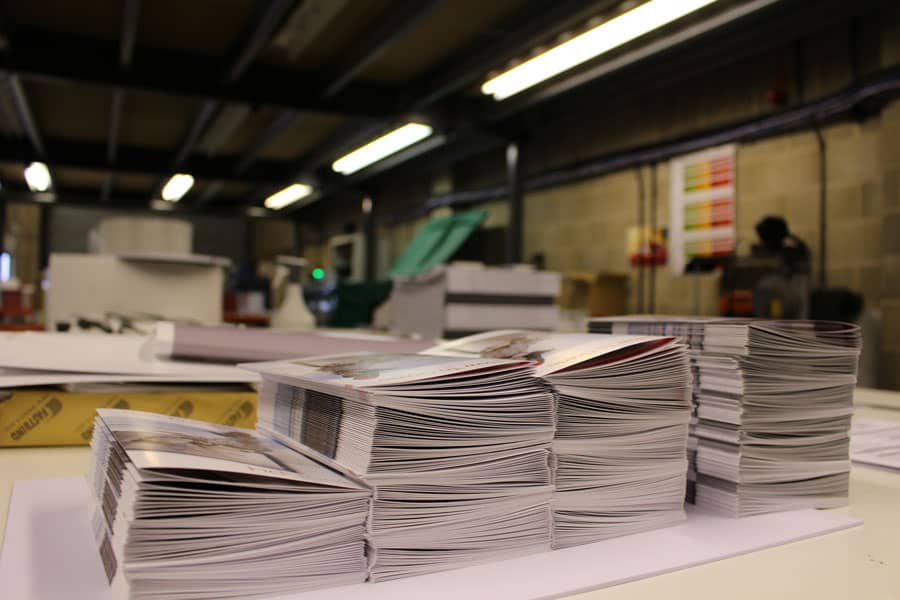

Sector: Commercial Printing

Location: Norwich

Reason for funding

Machinery upgrades

Solution

- Unsecured business loan

- Fixed repayments

- £65,000 over 24 months

Results

- Replacement of machine parts

- Fulfilment of new contract

When it comes to great footballing rivalries, you might think of Manchester United and Liverpool, Arsenal and Tottenham Hotspur, Real Madrid and Barcelona. However, with Fleximize’s roots set in the heart of Suffolk, we think of Ipswich versus Norwich – otherwise known as the Old Farm derby.

Fortunately, we don’t let footballing differences get in the way of our mission to help small businesses. That’s why we were more than happy to offer our support to Norwich-based printing company 2M Print in 2015.

The brainchild of father and son duo Michael and Mark Hipperson, 2M Print offers a diverse range of services, from digital and lithographic printing to large format printing and consumer-focused products including yearbooks, photo albums and custom print solutions. 2M Print’s unwavering focus on providing unrivalled quality printing and outstanding customer service has seen it grow exponentially, becoming a renowned and well-trusted brand within its space.

Funding to grow the business

In late-2015, 2M Print struck an exciting partnership with a global photography brand to launch an innovative new product into the commercial and consumer printing sector. However, to make the launch as smooth as possible, the company needed a small injection of external funding.

Managing director Mark Hipperson was already aware of the different funding avenues available to his business, such as asset-based financing and traditional banking. On the surface, asset finance might have looked the logical solution for a business with sophisticated and large machinery, such as 2M Print. However, with Mark just needing to replace small parts in one of the company’s machines, he decided to look for a lender that could offer a smaller amount of funding on flexible terms.

Fleximize helped Mark grow his business and repair vital equipment

Alternative sources of funding

Faced with the prospect of potentially waiting months for a decision from his bank, Mark began searching for alternative business lenders that could provide the money he needed, and quickly. After a friend recommended Fleximize to him, Mark had no hesitation in applying through our site.

After passing our initial checks, Mark was assigned a dedicated relationship manager who set to work creating a funding package that offered 2M Print the best of both worlds: the flexibility to use the funding for any purpose, and a quick turnaround to ensure that Mark could put his plans into action as soon as possible.

Within two days of applying, Mark had a funding offer from Fleximize, which he accepted. 2M print now has the necessary financial support to fulfil its partnership with the global photography brand, which will allow it to grow while maintaining a healthy cash flow. We’re looking forward to seeing where Mark takes 2M Print from here.

Do you run a business like this?

If you’re looking for an unsecured or secured business loan to grow your own printing company, or other type of business, contact the Fleximize team today on 0207 1000 110. Alternatively, click on the button below to open the door to quick and easy business funding.

These cookies are set by a range of social media services that we have added to the site to enable you to share our content with your friends and networks. They are capable of tracking your browser across other sites and building up a profile of your interests. This may impact the content and messages you see on other websites you visit.

If you do not allow these cookies you may not be able to use or see these sharing tools.