Generative artificial intelligence has captured the public’s attention in the last year. This includes GenAI technologies like ChatGPT, Claude, and Midjourney, to name a few.

AI tools have new applications that are being discovered every day. The technology can help large companies screen applicants. It can help postal services to parse and sort handwritten addresses. It can enable healthcare providers to detect early-stage cancers with greater accuracy.

AI can also protect eCommerce merchants from both pre- and post-transaction fraud threats. For our purposes, that might be the most immediately relevant application.

How Does AI-Based Fraud Detection Work?

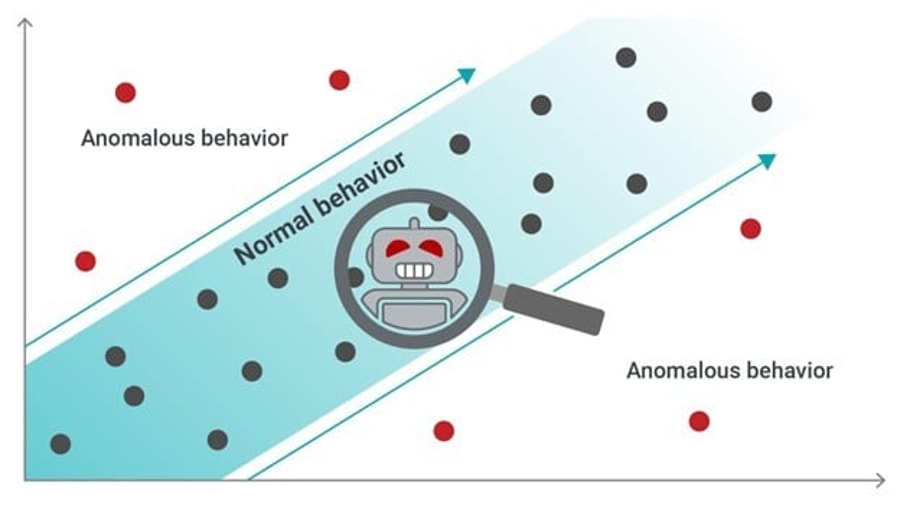

The answer lies in a practice known as anomaly detection.

AI-based fraud detection tools look for patterns and trends in large datasets. Systems deployed at checkout, for instance, can track myriad inputs, including:

- Buyer logins

- Password changes

- Average order volumes

- Product order quantities

- Transaction dollar value

- Time elapsed between checkouts

- Payment cards used

- Number of authorisation attempts

The “killer app” here is machine learning. Once the AI understands how “normal” buyers behave, it can watch for unusual buyer behaviour. The tool will then try to identify any transaction that deviates from the norm. One can configure the system to block those transactions. Or, to flag and forward them to human fraud analysts for manual review.

Why Anomaly Detection is Crucial

Not all outliers in a data pool are tied to fraud. But, fraud is a rare event, from a statistical and qualitative standpoint.

In the UK, roughly £9,053 is lost to fraud each year per every 1,000 individuals. At the same time, the average Brit spends around £2,600 per person each year online. So, the volume of overall fraud is still small relative to overall spending.

Behaviours associated with fraud are different from “normal” buying behaviours. It’s true that legitimate customers may engage in suspicious behaviours, like:

- Clicking on many products before placing an item in their cart

- Putting unrelated products in their cart

- Visiting a site many times before buying

- Abandoning their carts several times before checking out

- Checking out while not near their billing address

That said, fraudsters often exhibit distinct behavioural patterns that mark them as suspicious. For example, scammers may:

- Add large quantities of a single item to their cart

- Attempt to buy “near-cash” items like prepaid cards or gift certificates

- Try to checkout many times in rapid succession

The key is behavioural analytics. AI insights can give merchants a richer and more accurate profile of each buyer. AI can examine dozens of indicators at once. It can gauge whether anomalous behaviours are indicative of likely fraud.

In turn, transaction data gathered over time can help sellers refine fraud detection practices. It can help address security vulnerabilities in a deliberate, tactical, and efficient manner.

Key Benefits of AI-Based Fraud Detection

AI-based anti-fraud tools have several distinct advantages over manual fraud detection. For example:

Continuous Improvement

The most unique advantage of machine learning is the ability to learn and improve over time. Traditional algorithms are deterministic; they approach fraud detection using pre-defined mathematical rules. But, machine learning algorithms are dynamic. They can ingest new data and learn.

Better yet, AI fraud detection tools access a merchant’s individualised data. So, they’re customisable. Over time, they can be more adept. They can be fine-tuned against unique risk factors for each checkout environment.

Universal, High-Throughput Monitoring

AI fraud detection tools can track transactions in a cost-effective manner. This marks a significant departure from manual techniques. Relying more on humans means selective sampling due to bandwidth constraints.

AI-based fraud detection tools can examine every single transaction attempt. Volume, location, and time of day aren't factors. So, merchants can gain a complete picture of their checkout environment. They can minimise false negatives while providing a smoother checkout process for customers.

Near-Instant Decisioning

Even the most efficient teams can take hours to review a transaction. In comparison, AI systems can make consistent and high-fidelity decisions in milliseconds. This makes AI-based fraud detection tools an excellent first line of defence.

Some human oversight will still be necessary. But, AI fraud detection tools can flag transactions or provide risk scores. This helps human analysts make decisions with greater speed and accuracy. They can give a green light to low-risk transactions. That’ll free up time for human experts to tackle more challenging cases.

What About Potential Obstacles?

Now, the roll out for an AI-enabled fraud strategy requires careful consideration. For example, privacy concerns can be a hurdle. Businesses have to ensure compliance with data protection regulations. At the same time, they handle sensitive customer information. Doing both at the same time can be complex. It’s outside of most merchants’ area of expertise.

AI effectiveness depends a lot on the quality and accuracy of data. Issues related to data integrity, like incomplete or biased datasets, can hinder performance.

Financial barriers also come into play here. Integrating AI technology into existing systems can be costly. Plus, businesses have to train employees to work with new tools or processes. That may introduce more delays and expenses.

Addressing these obstacles won’t always be easy. But, it’s going to be key to implementing AI in fraud prevention strategies.

AI Fraud Detection: Real-World Applications

Merchants, government agencies, and other organisations are already exploring new applications for AI. But, there is still a lot of room for growth. Consider data from the 2024 Chargeback Field Report, which surveyed both US and UK merchants. Only 22.6 per cent of merchants say AI is now part of their fraud detection strategy. But, almost 40 per cent of respondents said they have plans to explore it in the future.

AI is helping identify patterns and anomalies that may otherwise escape human notice. To give one example, look at natural language processing (NLP) and sentiment analysis. These could assess emails and other customer communication for potential fraud. AI can judge language and flag possible scam emails based on the content.

In 2024, Chancellor of the Exchequer Rachel Reeves weighed in. She asserted that the public lost more than £7 billion to fraud during the pandemic. But, the government recently implemented new AI-enabled processes to tackle fraud. AI helped recover £480 million between April 2024 and April 2025.

We can look to Mastercard’s Scam Protect Service for another example. This uses a combination of behavioral biometrics and identity insights. The aim is to verify accounts before purchases. It identifies suspicious transaction patterns before they morph into full-fledged scams.

Don’t Fight Fraud Alone. Let AI Help.

AI is far more than a whimsical, consumer-facing generative toolkit. For merchants, machine learning techniques represent a proven method for anomaly detection. It can help fraud analysts check more transactions. It can enable merchants to make split-second decisions, all while improving over time. That's only when deployed correctly, though.

It's ironic. Thanks to genAI, fraudsters are also stepping up their game. They’re developing new tactics using voice cloning apps, deepfakes, and more. So, sellers will need to be insistent on staying one step ahead.

Leveraging sophisticated AI solutions that keep watch at checkout will be essential. But, AI will let merchants focus on what they do best. That is, helping legitimate customers fulfil their wants, needs, and desires.

About the author

David DeCorte is the Content Manager at Chargebacks911, a chargeback management company that protects over 2.4 billion online transactions every year, representing clients in 87 different countries. David covers the eCommerce, retail, and fraud prevention space, and his writing has been featured in Mashable, Business2Community, Fintech Futures, and other outlets.

These cookies are set by a range of social media services that we have added to the site to enable you to share our content with your friends and networks. They are capable of tracking your browser across other sites and building up a profile of your interests. This may impact the content and messages you see on other websites you visit.

If you do not allow these cookies you may not be able to use or see these sharing tools.